Decades of Freedom: How Longevity Can Impact Your Retirement

- RB Welborn Financial

- Jul 16, 2024

- 3 min read

Updated: Jul 31, 2024

How long will your retirement last if you stop working at age 60?

There’s obviously no definitive answer, but the latest data on life expectancy can tell us a lot.

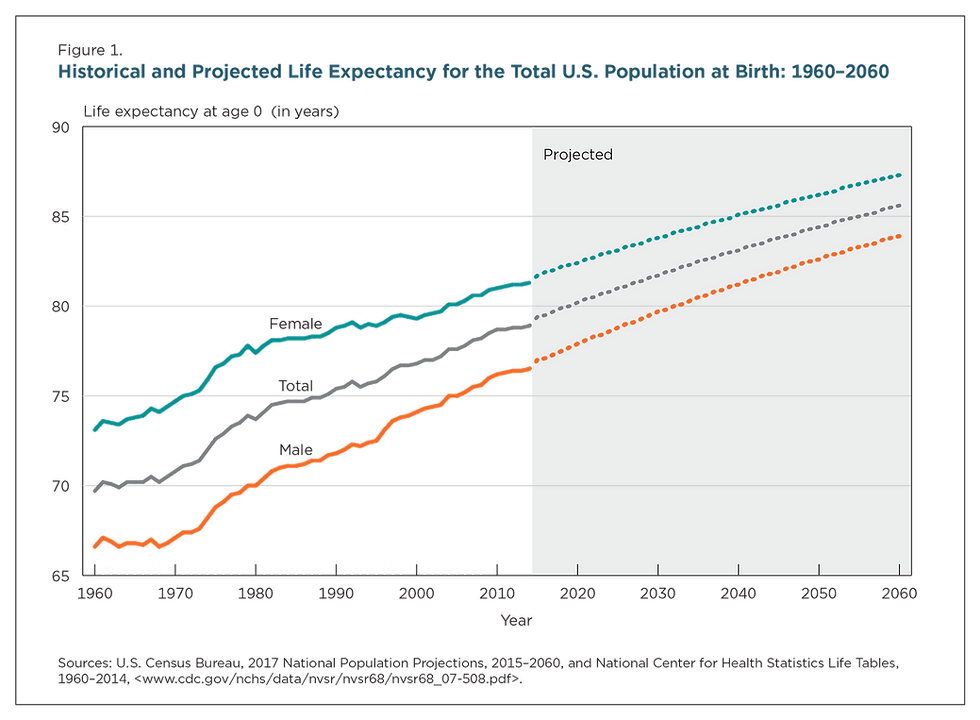

These days, retirement can last at least 20 to 25 years if you retire at 60.1 That’s around a decade longer than a 60-year-old retiree 50 years ago.2

And if you’re not retiring for another 10+ years, you could be looking at an even longer life expectancy in retirement.3

That means a 30, 40, or even 50-year retirement for some—allowing for, essentially, an entirely new life.

And though the gift of more time is certainly welcome, there can be obstacles. Which, if not met head-on in your retirement planning, could prevent you from experiencing the post-work bliss you deserve.

6 Considerations for a Fulfilling, Long-Lasting Retirement

Your Health & Wellness

It’s a simple and effective equation: The more you take care of yourself, the more years you’ll spend doing what you want with the people you love. Plus, prioritizing your health won’t just improve your quality of life, it can also help minimize your healthcare costs.

Tip: You probably know the drill by now. Maintain a healthy lifestyle, eat a nutritious diet, exercise regularly, and stay current on your regular medical check-ups.

2. Your Long-Term Care Plans

By the time you’re 65, according to recent averages, there’s a 70% chance you will need long-term care (LTC). Options may include adult day care, in-home care, or a private room at a nursing home, for example.1

If LTC is needed, you could be facing bills that range from $1,600 to more than $8,500 a month.1 And you may have to cover these charges for the next 20 to 25 years.

Tip: Even if you’re in tip-top health, to be safe, it’s best to crunch the numbers now. Don’t forget to factor inflation into your projected calculations.

3. Your Time

The thought of free time may seem like a luxury now, but for some retirees, boredom can be a problem. An overabundance of empty time in retirement can cause stress, depression, and other negative impacts that could take a serious toll on your mental and physical health.4

Tip: To avoid the excess TV or clock-watching, set up a flexible life plan before you retire, and if you’re already retired—start now. Consider going back to school, practicing your hobbies, volunteering, and traveling. And be open to pivoting and trying new things if your initial plans don’t work out.

4. Your Back-Up Plan

What type of financial “safety nets” do I have in place? Asking yourself this question can spotlight how much you really need to save, what resources you may need, and how to gain a stronger financial footing in the future.

Tip: Have a crystal clear understanding of your Social Security and/or other forms of guaranteed income, and how each could bolster your current retirement plan.

5. Your Relationships

What do most people miss when they stop working? It’s not the satisfaction of a job well done. It’s the social relationships they leave behind.5 Retiring can also disrupt your relationship with yourself and your loved ones, creating unexpected shifts in communication and socialization.

Tip: Give yourself the space to redefine your identity and purpose in retirement, then devote time to meaningful relationships. Set up regular social events, such as taking a new class, going on walks with the neighbors, having a regular date night, or hosting a weekly family dinner.

6. Your Support System

Beyond friends and family, where can you turn for advice or guidance when things become tough? Who’s your sounding board when you have to make complex decisions? And who can you rely on to help you see those proverbial blind spots?

Even just one professional you trust can be a powerful support system, especially when markets shift or plans go off the rails.

Tip: Before and after you retire, check in routinely with a financial professional. Consider it a “financial wellness” check to help ensure a long, satisfying retirement.

“Retirement is wonderful if you have two essentials—much to live on and much to live for.”

Sources